Adopting Technology to Stay Ahead

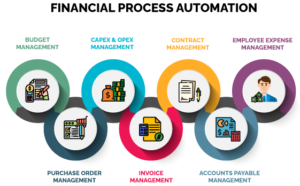

In today’s fast-paced business environment, financial processes automation has become a key factor in driving growth and ensuring long-term success. With the adoption of new technologies, organizations can streamline their financial operations, reduce costs, and improve efficiency.

The financial industry has traditionally relied on manual processes and paper-based systems. However, with the advancements in technology, automation has become the new norm. From invoice processing to payment reconciliations, technology has revolutionized the way financial processes are managed.

The adoption of technology in financial processes automation has numerous benefits. For one, it reduces the potential for errors and fraud, as the technology can flag any irregularities in real-time. It also frees up staff time, allowing them to focus on more strategic and value-added tasks.

Another advantage of automation is the ability to process and analyze large amounts of data quickly and accurately. This enables organizations to make more informed decisions based on real-time insights, which can be critical in today’s competitive business environment.

In addition, automation can provide greater visibility into financial processes, giving managers better control and oversight. With the ability to track and monitor processes in real-time, managers can quickly identify and address any issues that arise in various process and provide better customer experiences by focusing on:

- Streamlining workflows: By automating workflows, fintechs can eliminate manual tasks and reduce errors, enabling them to process transactions faster and more efficiently. This helps in tracking and monitoring the process at every stage.

- Real-time analytics: By integrating analytics tools with automated processes, fintechs can gain real-time insights into their operations. They can track transaction volumes, detect anomalies, and identify areas where processes can be further optimized.

- Notifications and alerts: Process automation can be used to set up notifications and alerts for critical processes. This allows fintechs to monitor transactions and flag any potential issues in real-time.

- Integration with third-party systems: Fintechs can integrate their automated processes with third-party systems, such as payment gateways, fraud detection systems, and regulatory compliance tools. This helps in tracking and monitoring transactions and compliance requirements in real-time.

- Reporting: Automation tools can generate real-time reports that provide insights into key performance indicators (KPIs) such as transaction volumes, processing times, and error rates. These reports can be used to monitor processes and identify areas where improvements can be made.

The adoption of technology in financial processes automation is not without its challenges, however. One of the biggest hurdles is the resistance to change from staff who are used to traditional manual processes. This can be overcome through proper training and communication, emphasizing the benefits of automation and how it can improve their daily work lives.

Another challenge is the initial cost of implementing new technology. However, this is often offset by the long-term cost savings and increased efficiency that automation can provide.

In conclusion, the adoption of technology in financial processes automation is critical for organizations to remain competitive in today’s business environment. It provides numerous benefits, including reduced errors and fraud, improved efficiency, better decision-making, and greater control and oversight. By overcoming the challenges associated with adoption, organizations can stay ahead and thrive in today’s rapidly changing business world.